Introduction:

Brampton, nestled in Ontario, Canada, offers a vibrant community and a thriving real estate market. Yet, navigating Brampton property tax system can be daunting for homeowners and investors. In this detailed guide, we delve into Brampton’s property tax intricacies, offering insights, comparisons of tax rates from previous years, and visual representations through charts and graphs to aid Canadian homeowners and investors in their understanding.

Brampton Property Tax Fundamentals:

A property tax is the main source of financing for extracting world-class services from the Brampton municipality, like transport, education, and public safety. The tax is levied per annum and is set as % of the property’s assessed value that lies within the municipal limits. Cities gather information on the tax rates to be charged for properties through the consideration of their budgets and required expenditures.

Factors Influencing Tax Assessment:

A set of factors in Brampton determines the brampton property tax. The overview contains information such as the area, the location, the condition, and the renovations to the property. Assessments can also suffer from problems external to organizations, like market conditions that are ever-changing and differing municipal budgets. Knowing what goes into the formula for homeowners and investors is crucially vital to making sense of how the taxes on their properties are determined.

Comparative Analysis of Tax Rates:

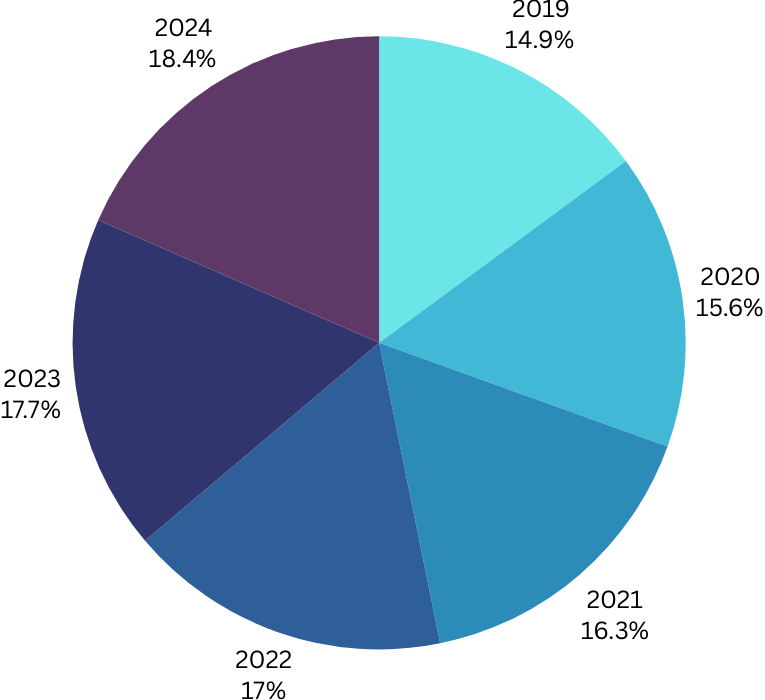

To provide insight into the historical trends of Brampton’s property tax rates, let’s examine a comparative analysis over the past five years:

| Year | Average Tax Rate (per $1000 assessed value) |

|---|---|

| 2019 | $6.30 |

| 2020 | $6.60 |

| 2021 | $6.90 |

| 2022 | $7.20 |

| 2023 | $7.50 |

| 2024 | $7.80 |

A more clarifying way of putting this is the fact that property rates have always been on the rise for the last five year, owing to the fact that municipal budgets and conditions change from time to time.

Impact on Homeowners and Investors:

To the majority of the residents in Brampton and the property investors, seeing property tax implications that may be around the corner is vital when it comes to personal budgeting and planning for the future. Not only can gradual tax rates charged on a business be a barrier to home ownership, but they also reduce investors’ return on investment. Keeping yourself updated on both property tax rate changes and assessing them in terms of how much financial impact they might have on your current budget is a must.

Read >>> Guide to Real Estate and Property Management

Strategies for Managing Property Tax:

On the one hand, property tax is a compulsory payment for every homeowner and investment property owner. However, the deft usage of different strategies is a good approach to assist in managing and minimizing its impact. These include utilization of available tax credits, making use of property tax rebates for homeowners with eligibility status, among other initiatives, and strategically planning on taxes to maximize your resources.

Conclusion:

In the end, Brampton property tax has a remarkable impact on Canadian home buyers and investors, and they have to pay a rather high amount to settle down at their house. It also influences the city’s overall financial scene. By knowing the determinants of property assessments and spending some time researching previous tax rates, homeowners and investors can navigate Brampton’s complex property tax system confidently and meritoriously. With the town growing swiftly, it is like having a popular TV series; it will remain imperative to provide accurate information about the property tax trends and updates to ensure that good financial management is attained and sustainable development is upheld.