Discover how the Money 6x Ratio can maximize your wealth, providing strategies and tips for rapid financial growth.

Understanding the Money 6X Ratio

If one possesses simple kin understanding connected with the stockpiling of wealth, then there is nothing like « Money 6x Ratio » which can be recognized as the best asset for the effective increase in financial gains. This strategy focuses on Elevating the six figures of income or different revenues, income-producing, investment, or savings, establishing stable and diversified investment project. When using the approach you will be in a position to lay the correct weight between the dangers and potential gains in the development of the complete wealth.

For instance presuming that your have been appointed in a recognized firm, Money 6 x Ratio challenges you to look for other five legal ways of making money such as buying shares, company properties or even beginning an additional business.

It also fuels several opportunities for raising the amount of capital, besides eliminating the risk associated with changes in market forms. Also, for another reason, to make your potential become actual money that increases your progress and reach your goal much more soon, you need to pass the Money 6x Ratio to your savings and other investments. The knowledge and application of the concept enables one to safeguard his/her wealth from a total dependence on any particular source in order to meet his/her needs and achievements in future.

Making money it is not an easy task in which an individual or a cluster of individuals get enough money for reinvestment purpose in the creation process and other value addition. Of many talents that one can use, there is always one technique that is highly useful for increasing income with Money 6x Ratio strategy. It is designed to address issues of concentration and geographic dispersion of income, investment or savings by using the ‘six times ‘ rule. Through understanding the principle one should develop good financial plan, which can create wealth faster than destroying wealth during the time of recession in business and money markets.

Diversifying Income Streams

The following is an explanation of the Money 6x Ratio pillars: The first one is income stream diversification In this case, the basis of the asset is the diversification of the income streams with the view of creating a hedge against the market risks. Single breadwinner basically means that the family has only one source of income which is rather dangerous in modern society where it is quite challenging to attract employment. This means that employment becomes hard to come by and the nature and conditions of the economy are constantly changing; something that may have an impact on one sector may not necessarily hinder development in the other. When you adopt different incomes you can manage to do away with such risks that accompany a friendly environment of the single income.

Primary Source of Income

Your main business or commerce is your primary source of income or your first or principal employed occupation. It is your base although it is a major source of finance or rather your primary financial strength. For that, ask for a raise or a new position, try to increase the business, etc. Expand your knowledge about your work, your field, your industry, and seek a better paying job that you or your staff need. In business, search for prospect when looking for an opportunity for expansion by aiming at enlarging customers’ base, increasing efficiency or transiting to diversification.

Additional Income Streams

Money 6x Ratio means that you should implement five more sources of income in order to achieve the desired goal. This can be case work or any jobs that are not the main source of income, rental income, dividends, royalty from the intellectual property among others. These streams should also be pursued independently, kept in mind the skills one possess, areas of interest and resources available.

1. Freelance Work: Using your skill-set as a freelancer allows you to tailor your time and efforts and can also be a very rewarding side job. Freelancing for consultancies, writings, designing, or programming helps people to earn extra cash from their specialized field apart from the general job.

2. Rental Income: Offices and other residential properties can be a good investment because the returns are more guaranteed in terms of rent. This involves dealing with substantial capital and precise property management from the onset but on balance once the hustle has been done the passive income is remarkable.

3. Dividends and Investments: An investment in the stock, bonds, or mutual funds pays a periodic amount in the form of dividends and interest. This entails a deeper appreciation of the financial markets and a systematic investment management process with the end goal of creating both growth and income assets.

4. Online Businesses: Selling merchandise or other products via the internet such as the affiliate marketing approach or even developing an e-Book or online course sales are massive incomes. This way the Internet opens an extensive area of demand, you can gain an access to an international public and thus generate a possibility for a scalable income.

The Money 6X Ratio is a principle of finance that was created to harness, collect, and use money effectively. With this ratio, the person can forecast the ratio of returns to risks, where resources can be used optimally in order to attain the highest returns at the lowest risks. It stems from the fact that the wealth has to be deployed across different types of investments and hence its distribution across all the potential opportunities. It represents the proportionate division of the funds in order to invest in a diversified and balanced manner and capable for sustaining as well as recovering from any down turn or economic calamities. Combined with financial insight of multiple traders that have researched the trends and behaviours of investors for years, Money 6X Ratio is based on classic and modern knowledge about money. It emphasizes the need for a disciplined approach to money management, advocating for the systematic distribution of funds into six distinct categories: Check your checking account to determine the amount of money you have in savings, investments, or an emergency fund, money that has been set aside to pay off your debts, money that is available for spending on things you want or need and money that you are saving for retirement, for a house, or for any other long-term goal that you may have. Thus, each categories is useful in the provision of financing and stability and growth of a business, which is why the Money 6X Ratio is such a holistic strategy for wealth generation.

Nowadays, the Money 6X Ratio has never been more pertinent in the context of the current state of global economy. This can be seen as the rates change and competitive environment becomes more dynamic, having a disciplined system for managing money is essential. It becomes easier for those who are using the money to know how to do it best with an understanding of the right proportion between the two entities. The guidelines of the Money 6X Ratio allow people to maintain an optimal economic diversification strategy, which would address both the pressing present requirements and long-term goals.

The Money 6X Ratio is not only an effective tool but its practical applications and examples and case that show this fact. For example, let’s take John, a mid-leveller manager, who used the ratio in his plans concerning money. Living by the 6X categories meant that he had a cushion since he saved for his expenses, bought assets that would help get rid of debts faster, and invested in avenues that gave higher returns. In the same way, analyzing the example of a small business owner describes how vital the Money 6X Ratio is, as it helped the individual use the money earned to reinvest wisely and maintain sustainable profitability.

Altogether, the Money 6X Ratio provides a nice game plan that the people who want to control their resources as efficiently as possible should strictly follow. Its approach to money is evenly balanced, and it makes financial resource management efficient, thereby leading the way to a healthier financial life.

Implementing the Money 6X Ratio in Your Financial Planning

That means the most advisable way to invest and save money in the present and future is in terms of the Money 6X Ratio entails a real life, real time, comprehensive analysis of an individual’s financial position. This step includes determining total amount of earned and received income, monthly expense, savings and investment. Thus, understanding in which place you are placing financially it would be possible to determine what aspects should be corrected and on which basis the Money 6X Ratio methodology is based.

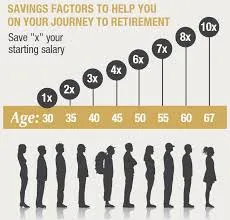

Following that, there should be realistic financial goals set, Taking up the next point, let me stress it is necessary to have genuine financial goals. Depending on your goal, whether it is to create a contingency fund, save for a home, or invest for retirement, clear goals will dictate the use and investment of resources. The Money 6X Ratio suggests dividing your income into six distinct categories: subsistence needs, consumption, financial and real investments, education, recreation, charity giving, and other. Such diversification enables a student to have a balanced view of his or her financial management plan, and this is crucial in the attainment of the aims of financial stability as well as growth.

The first step is to set up a large percentage of your income to wipe off all your core or basic needs including shelter, energy and food. Subsequently, to ensure financial stability, consider saving money as it provides a backup plan in case of emergencies occur. The other crucial element that needs to be spent is investment, and it must be focused on buying things that create wealth. Another mandatory expense is educational necessities such as tuition fees, books, etc that can expand your income in the course of the years. Leisure represents buying goods and services for one’s own pleasure but in a manner that will not affect their ability to save in the future while donations means giving away money toward issues that the individual deems worthy in a way that they are able to benefit from the sense of giving back to society.

To monitor the Money 6X Ratio, use the budget and handy financial related applications that will provide the necessary information about the expenses and help follow the rules. The management of the plan requires constant monitoring, tweaking, and possible adjustments in an effort to keep on track. It means that by periodically revisiting the initial division of the money one can have a high level of confidence that his or her spending plan reflects his needs and is adjusted for any changes.

Applying the Money 6X Ratio is not a one-time action plan; instead, the effort encompasses ongoing dedicated tenacity. If you follow all these steps and implement some of the practical tools discussed here it will help you in planning and thus can help you to plan for effective wealth accumulation.

Common Challenges and How to Overcome Them

The adoption of the Money 6X Ratio can indeed be a journey which changes the financial picture of a business for the better and leads them to wealth creation. However, it is not without its challenges such as time constraints and over reliance on computers. Among them, the main shares are dedicated to such a barrier as working with emergencies. Unexpected expenses like hospital bills, car breakdowns, or being laid off from work can throw even those with the best personal finance strategies off track. To guard against this, it is advocated that an emergency fund with enough money to cater for at least three to six months of the employee’s expenses should be saved and kept aside. This is an emergency or rainy day fund and gives the ability to balance expenses when one is faced with an unexpected bill that would have otherwise needed to withdraw from savings and/ or investment accounts.

High market risk is also a major challenge, as well as LVLT. As earlier highlighted, the value of investments is not constant and is subject to changes with volatility related to economic milestone, political changes, and other activities within the market. However, to manage this, portfolio diversification becomes a crucial aspect to consider. They recommend that diversification of assets involves putting your money in a variety of assets like stocks, bonds, property, and even foods resources to minimize any undue effects of market fluctuations on your financial status. Furthermore, the application of a long-time horizon strategy will enable your wealth to maintain a constant rise despite the rhythmic oscillation encountered in the near future.

Another limitation based on the principle of implementing the Money 6X Ratio is psychological barriers including aspects such as fear of loss and lack of discipline on money matters. They surmount must be managed knowingly that changes are inevitable, as Carroll suggests. Getting an education becomes very important in this case. Studying these principles and understanding the available investment strategies makes one confident with their choices. Daily goals are useful to manage work, but more important can be setting daily financial targets which will help to stay motivated and keep one’s eye on the prize. Changing the saving and investment goals to automated ones can also help to avoid slippage of the habit as it enables you make regular contribution towards the financial goals.

In conclusion, the barriers that include fluctuating costs which may still arise despite the business owner planning adequately, the market fluctuations as well as the psychological barriers make it difficult to implement the Money 6X Ratio but they are not genetically impossible to overcome. It enables you to ensure that you are able to overcome these barriers and remain focused to build your wealth effectively; You should begin saving money in order to create an ‘Emergency Fund’, Invest diversely, and develop a disciplined and informed mindset towards saving and investing.

Success Stories and Testimonials

Applying the Money 6X Ratio has always been an eye-opening affair given the different experiences from different points of financial strength. People have been able to share the income in a manner that has ensured their wealth is at its optimal best by ensuring total gains that has brought about a secure financial future. Here are some examples which show how the Money 6X Ratio can be applied in different fields and where it has proven to be successful.

John who earns a decent income as a middle income earner had been experiencing challenges of alienating money in his wealth building exercise. He had to make radical changes in his spending style after finding out that the Money 6X Ratio was at his disposal. This ratio, therefore, works best for those saving towards specific financial objectives as John was able to save quite a lot within a year strictly following the set ratio. The monetary constraint that he had observed earlier helped him in investing and building his capital in stocks. Mr. John has a lot to say about Money 6X Ratio those are strategies for better finance he managed to get his finance turned around.

Many people that are in the early working stage also struggled with money, for instance, 26 year old Sarah, a college graduate, with student loans. However, she applied a new method known as Money 6X Ratio in order to sort out her income flows. Overall, putting more effort in paying off the remaining balance and savings were very fruitful as Sarah was able to improve the financial strength in the next two years. With the help of these funds she managed to pay off a part of her student loans, as for the extra funds the emergency fund was also created. Through Sarah’s success story, it is evident that Money 6X Ratio acts as a beneficial factor in assistance to young adults who have bad financial situations.

Michael and Lisa, a couple with two children and the earned income, sought for a solution on how to overcome their challenges in financial planning specifically for the kids and their perceived post working years in life. They also engaged the Money 6X Ratio to ensure they budgeted their $525 jointly as required efficiently. Constructing a strong financial base in a disciplined manner, they were also careful with their investments. Today, they are sure about their retirement and have planned for college funds for children etc. , all of which is due to Money 6X Ratio which is more structured.

These are the independent testimonials that point to the usefulness and effectiveness of the Money 6X Ratio in a wide range of business and corporate environments. If you are new to the world of handling money or you are in the middle of the process looking for ways to further improve on what you are doing, the Money 6X Ratio is a solid guide to help you attain financial solidity and wealth.

Conclusion

Of course, the process of becoming financially secure or, at least, of finding ways for increasing one’s cash assets is undoubtedly challenging, but the concept of Money 6X Ratio is a powerful guiding star for those who opt for knowing and influencing the dynamics of their personal financial status. In this manner, it is possible to contribute a whole lot in the management of this ratio to ensure the wealth of people is enhanced in the right manner. Thus, the plan that underlies the Money 6X Ratio can be defined as a balanced concept, as it implies that part of the income should be allocated to the coverage of certain needs, the preservation of some amount for future, the investment in oneself, and the repayment for the debt.

The Money 6X Ratio cannot be established without prevailing and a good plan needs to be established to achieve it. They are not simply about splitting one’s profits but it is about truly knowing what goals are pertaining to that certain segment. This ratio supports the idea of an logical share of earnings on spending more, specially on what is known as savings and investment, which signified very much in improving the financial future. By more frequent application of this ratio, people can develop a secure financial base that would be easy to manage in all kinds of circumstances and crises, but also to actively use to expand the capitals already on hand.

In addition, is the Money 6X Ratio also looks at being more active in managing the amount. As opposed to simply overthinking financial losses that may occur in the future to safeguard against them, this procedure encourages planning and long-term vision. Hence the importance of annual revisions as well as monitoring to keep one’s financial plan on check and in line with goal changes and the ever dynamic surrounding circumstances. Taking such measures not only helps to strengthen an individual’s financial protection but also is likely to foster a sense of security or assertiveness in managing the individual’s money.

Finally, the Money 6X Ratio does not only serve as a technique for evaluation of financial performances but it is an effective approach to encourage people towards being more conscious when it comes to handling their money. However, for those people who have devoted themselves to the philosophy of effective wealth acceleration, [this ratio] can be incredible. Through the implementation of practical measures towards achieving the Money 6X Ratio, people can also lay down the groundwork to help them attain the goals they hold for their financial future and creation of wealth.

Frequently Asked Questions (FAQs)

It is important to comprehend how the Money 6X Ratio works as it can make a significant difference when planning for financial balance and prosperity. Here, we include answers to some of the frequently asked questions and some concerns related to this financial strategy so that you can include it in your financial strategy effectively.

How flexible is the Money 6X Ratio?

Specifically, the Money 6X Ratio is not fixed, but individual, in that it varies according to the person’s financial scenario and objectives. It gives a systematic plan of the handling of your cash, with the division of it into six groupings. But plausible changes can be made according to the individual conditions and the extent of the financial goals. The Money 6X Ratio is relevant to those who are earning high income and those who have modest employment income, thus, the strategy can be adopted according to one’s income levels for wealth building purposes.

What if I am in debt? Should I still use the Money 6X Ratio?

Using Money 6X Ratio while in debt may seem quite strange and in fact it is possible and advisable to do so. In the mentioned ratio, there is a category for paying off debts as one of the primary financial obligations. This helps to guarantee that some of the organizational income is always channeled towards repaying the debt. With the Money 6X Ratio it is possible to deal with the owed amount in an orderly fashion while at the same time, saving and investing and thus have two angles covered when trying to regain the financial health of a household.

How can I balance saving and investing with the Money 6X Ratio?

Thus, by answering the questions that, according to the results of the poll, people ask most frequently, we would like to show that the Money 6X Ratio can be an effective planning tool across various fields. Its flexibility and form allows it to suit any form of money related circumstance possible allowing you to live your life financially tactical.